Contents:

I would like to change the account to a specific liability account for Guideline deferrals. When I try to do this, it tells me I have to go to Employee Benefits and select Manage Plan for Guideline. I do that, but when I log into Guideline I can’t find a setting to update the liability account. In how they use forfeitures, but there are important timing restrictions.

Select the account that records the deduction or donation to be made in the Liability account area. Once done, you nowcreate a one-time paycheckfor your employees. After processing it, delete the contribution by going back to theDoes this employee has any deduction? Employers can allow employees to select between a corporate match in a Roth 401k and a conventional 401k beginning January 1, 2023. Employer matching contributions must be made into a normal 401k under existing law, even if taxpayers contribute to a Roth 401k.

How to Setting Up 401k Account, Deductions and Employer in QuickBooks?

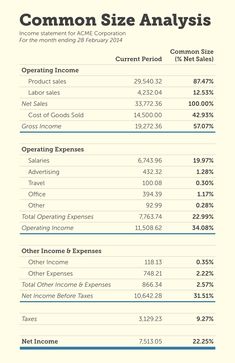

Check the numbers against the data you gathered from your payroll system. Does the total gross wage expense entry tie to your total payroll expense for the period? Be sure to confirm that your debits equal your credits . In case your payroll service deals with your payroll taxes, the amount you pay is higher based upon the business paid payroll charges are connected.

To set up the payroll time for the retirement benefits, you can follow two different ways EZ setup and Custom setup. Here, we will show both ways with step-by-step instructions. Let’s learn how to set up 401k in QuickBooks Desktop. Hold the following journal category and submit it every time you receive the payroll report from the payroll service.

Custom Setup (Recommended for Experts)

If there is a days sales in inventory you plan to run often, you can favorite the report by clicking the star to the right of the listed report. If you have run payroll in the past, all payroll-type reports should be populated here, as well as employee-type reports. Paycheck history reports allow you to see past paychecks, past payment methods and past paycheck status. FFCRA CARES Act reports include information regarding credits tied to COVID-19 pay. Sometimes these reports contain too much information, so you or your accountant may want to customize or limit the information reported.

After that, apply the filters, select the fields, and then do the export. When making retirement savings plans, QuickBooks’ 401k plan or one of its variations can be the most helpful. We presented various approaches in our blog for setting up this plan in QB.

- Before taxes are taken out, it helps employers to save and spend a piece of their paycheck.

- The above information has provided you the details related to how to set up 401k in QuickBooks.

- The entry for Checking is a Payment against the Liability where you should have accrued the expense.

- QuickBooks can accommodate a variety of retirement plan options.

- It is a known fact that 401k is nothing but a retirement savings plan.

If you are going to learn how to record IRA contributions in Quickbooks, here are a few IRA financial products you should know about. If you are just inputting some basic data, it is not too hard to record IRA contributions in Quickbooks. Then, just input the name of the retirement plan or provider.

What is an IRA?

Apart from this, if you want to set up a Roth 401K plan, then you need to look for the Employees tab. The given tab provides the details of all the employees and lets you perform the setup. Total pay reports summarize an individual employee’s total pay and type of pay, such as hourly wages, salary or commission.

Moving up, moving on and making waves in Billings in 2017 – Billings Gazette

Moving up, moving on and making waves in Billings in 2017.

Posted: Wed, 13 Dec 2017 08:00:00 GMT [source]

”, after that click on the Add New Deduction button. Here you can find the possible circumstances to enter payroll into QuickBooks. First, click the import button on the Home Screen.

To do 401k setup, you need to do payroll set up and it can be done by two methods including EZ and custom set up. 401k setup automatically adds the company contribution to employee retirement benefits. For example, write “401k Expense” in the accounts column and “$500” in the debit column. When recording payroll, you’ll generally debit Gross Wage Expense, credit all of the liability accounts, and credit the cash account. Gross Wages will appear on your Profit and Loss or Income Statement, and the liability and cash accounts will be included on your Balance Sheet.

In the Affect Accounts window, make sure “Affect liability and expense accounts” is selected, and then click OK. Give it some time and the Roth 401k plan will be set up on the QBO software. To make any changes to the values entered or selections made, you may use the Edit option. You also need to make edits in the items of the payroll for confirming that the details of the vendor have been mentioned accurately. If you have created custom reports in the past, you will be able to access them next to the standard reports.

How To Record IRA Contributions in Quickbooks

Her expertise allows her to deliver the best answers to your questions about payroll. After that, place the checkmark for the “Employee is covered by a qualified pension plan” option only if the employee participates in 401k or other plans. However, 401k programs are subject to various and specific rules, regulations, and criteria for tax qualification.

Who’s Hiring in Clarion County – exploreclarion.com

Who’s Hiring in Clarion County.

Posted: Tue, 11 Apr 2023 14:16:10 GMT [source]

Go to the How much do you want to pay your employee? From the left menu select theGear icon andselectPayroll Settings. I’ll make sure that you can record an employer 401k. Also, we have Quickbooks Assisted Payroll, so I don’t need help setting up manual payroll in QBDT.

- Further, go with the prompts that come up on the page.

- I just posted again – before seeing your reply – that I finally found the liability accounts and was able to reduce them appropriately.

- Gusto does not remit payment to third-party service providers, so please ensure you make these payments yourself.

- Select the account that records the deduction or donation to be made in the Liability account area.

- You can use calendar dates, months, quarters, years or specific payroll schedules.

- Allow me to chime in and share some information about how you can set up the Employer Match additional item in QuickBooks.

This helps employees to save and spend a portion of their paycheck before levying taxes. Taxes will not be collected until the money is withdrawn from the budget. All employee deductions are company liabilities so the payment is a payment of the liability. This liability is already recorded in QB since you use QB payroll. A couple of ways to approach this, if tge liability shows in QB Payroll as unpaid, pay it and match to the bank feed transaction. Or , starting with the feed item search for a match to find either the unpaid liability or the payment transaction made by QB on your behalf.

Intuit Stock Forecast, Price & News (NASDAQ:INTU) – MarketBeat

Intuit Stock Forecast, Price & News (NASDAQ:INTU).

Posted: Sun, 23 Aug 2015 16:34:38 GMT [source]

This account will be used later to track your deduction. The best approach to entering your payroll precisely is to understand the differentiation among gross and net payroll. Net payroll is the total amount you pay your specialists beforehand deductions. Net payroll is the element that your workers are paid after searches.

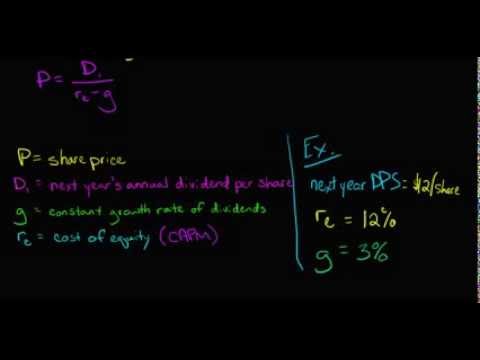

The contributed amount is stored as a saving from which the employees can benefit during their retirement. Post-retiring, this benefit can financially help such employees. It is set up for making tax-free withdrawals throughout the retirement period. This setup can be done in QB and then the employers can start contributing the amount. QuickBooks Online allows you to generate many standard and custom payroll reports. The accounts that you need to set up to track payroll will generally be an expense account or a liability account.